Zendesk Products Used

3

Support Hours

365/24/7

Agents

18

Average Weekly Volume

3,200

Products Used

Starling Bank is transforming British banking and challenging the high-street giants as the first mobile-only bank to offer UK current accounts.

Starling Bank has built a bank from scratch, enabling it to connect customers to the latest technology that adapts to and supports their fast-paced lives.

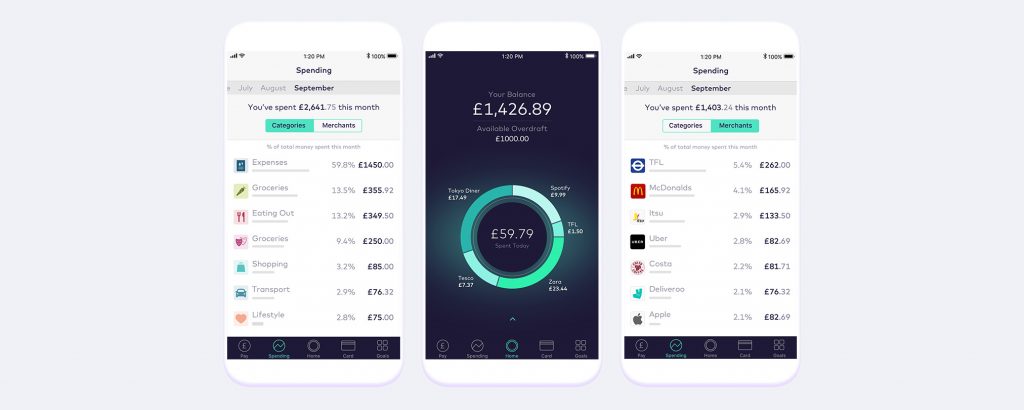

Starling’s current accounts allow customers to manage their money entirely through the Starling banking app on their mobile. This means they can access their money wherever and whenever they want to. Features include real-time mobile notifications for income and outgoings, automatic spending categorisation into travel, groceries, and so on, and no fees from them when using a Starling card abroad. Providing exceptional 365/24/7 customer service is fundamental to Starling’s success.

Patrick Vardhan is Head of Customer Service at Starling Bank. Since Starling’s service opened to the public in March 2017, the support staff has grown from three people to more than 18 full-time and part-time operatives. The team is engaging with customers more and more each month—currently handling up to 500 customer contacts each day.

When Vardhan started in October 2016, he knew that Starling Bank would need a SaaS customer service solution that could grow with the business. “We’re building a product for everyone who seeks to connect with technology to improve their everyday lives,” he said. “Our banking app is not an addition, it is the foundation of the service we are providing—technology is integral to everything we do and how we are building a better bank for everyone.”

When looking for a software solution that could handle such diverse and growing demands, Vardhan found that several Starling team members were already familiar with Zendesk Support—the ideal software for Starling.

“The great thing about being a start-up is that we were in the fortunate position of being able to choose our customer service software,” noted Patrick. “We weren’t restricted to outdated legacy systems.”

One key attraction of Zendesk is its ability to help Starling talk to all customers, no matter which channel customers decide to use. In addition to Zendesk Support, Starling rolled out Zendesk Chat and Zendesk Talk.

“We run a 365/24/7 contact centre across various channels including live chat on desktop and in-app live chat for mobile. It is vital that our customers can reach us at any time, day or night. Wherever our customers are, Starling is there to support them, and it’s all managed by Zendesk,” Vardhan said.

As expected, the business and the customer service team have had to scale quickly since implementing Zendesk. In order to make sure Starling can be flexible and adaptable as they grow, each agent is trained to provide across-the-board service, and help connect any specific enquiries to the relevant team—for instance, media enquiries or volunteers for case studies.

“Unlike other customer service teams, we don’t have specific members of the team dedicated to different contact methods. Everyone has the skill to respond to any contact method. Zendesk allows us to do this, as well as enabling communication outside the immediate contact centre team to other teams at Starling. We can easily move requests to and from other teams. We can even create custom views for other teams: they don’t need to see all the details, just the information relevant to that customer query. This way, each member of the team knows what they’re dealing with and the whole team has a view into what the customer needs.”

As a new company disrupting the banking industry, Starling Bank’s capacity for tracing and analyzing customer journeys is a key part of tracking their progress, also enabled by Zendesk’s capabilities.

“Our favourite feature of Zendesk is that it allows each engagement with a customer to be linked to a support ticket. This means that each point of communication with a customer can be seen by all authorised users,” Vardhan said. “We therefore get a clear map of our customer service journey.”

One dimension of tracking customer service is Starling’s categorization of contact with customers according to their urgency and nature. “This gives us great visibility into customer satisfaction, in real-time. We plan to use this data to understand the best method for our customers to contact us, and make sure we’re providing the best service we can on each channel. For example, if we see that Monday afternoon is always the busiest time for chat, we can make sure we have more employees on chat on Monday afternoon.”

Starling is currently looking into how it can extend support to even more channels with Zendesk, and is testing integrations with Google Play Reviews. Future possibilities also include support via SMS.

Vardhan fully recognizes that proactive customer communication is the key to the Starling’s current and future success. As he expressed, “Our customers are at the heart of everything we do—our contact with the Starling community is fundamental to the development and improvement of the product and service we are building.”